One Day Million Dollar Insurance Policy Cost

100 Million Dollar Life insurance Policy Cost For A Female. The idea of one carrier taking the risk on a 100 million dollar life insurance policy is slim to none.

Ad Spend Of Selected Insurance Brands In The U S 2019 Statista

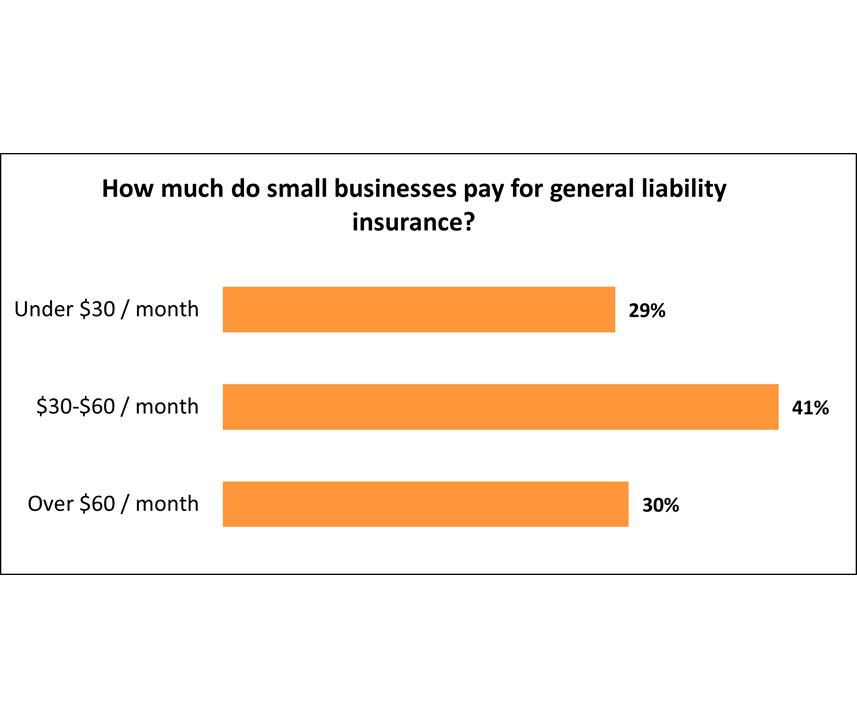

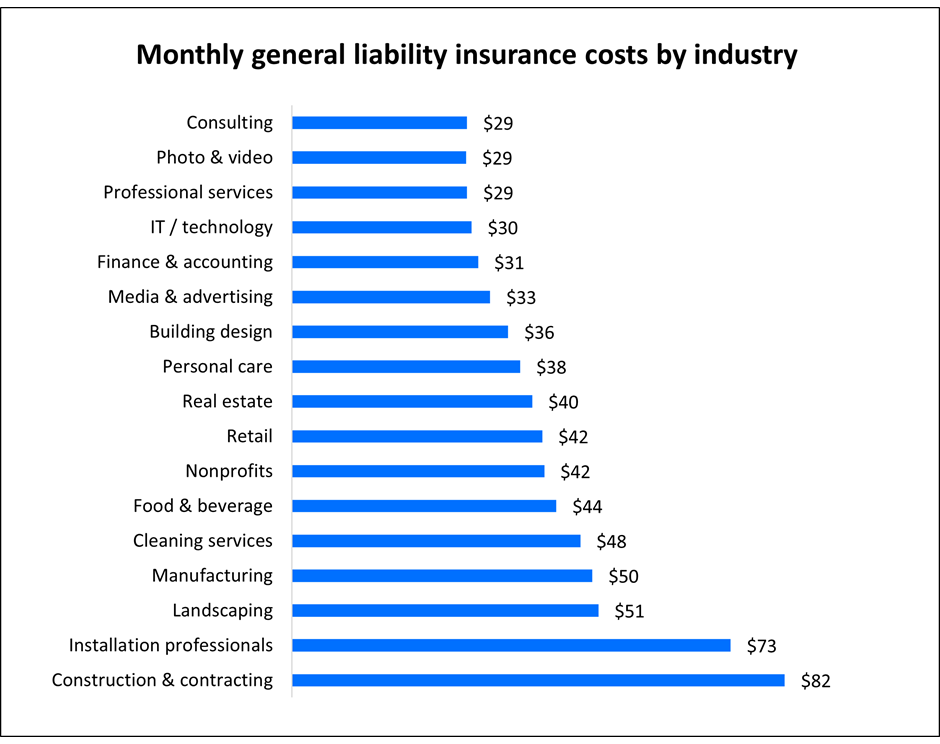

Larger businesses tend to pay more for general liability insurance due to the increased risk large businesses face with more clients locations products etc.

One day million dollar insurance policy cost. Is a million-dollar life insurance policy enough coverage for me. 10 Million Dollar Life Insurance Policy Cost. The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors.

So this way you will be able to get a 1000000 whole life insurance without a medical exam. Term policies are significantly more affordable. To review a range of life insurance options and rates contact an independent agent in our network.

One of these agents can help you compare. More coverage costs more too naturally. How Much Is A One Million Dollar Life Insurance Policy Cost Going To Be.

20-Year Term Monthly Premium. Of course the size of your business matters. For a 20-year policy a healthy nonsmoker might pay approximately 40 per month throughout their 30s 95 in their 40s and 245 in their 50s.

This also ensures that you will be able to cover those monthly costs. If something should happen to you and your family needs to carry on would an estimated 30 to 100 monthly premium for a 1 million term policy be worth it to you. Weve also provided some life insurance rates by age gender and risk class for 5 million dollars of term and permanent life insurance coverage to help you estimate the monthly cost of your policy.

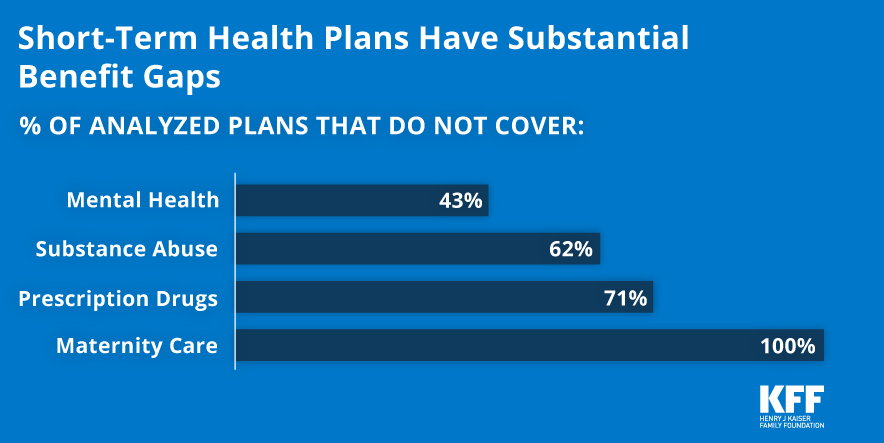

Remember that you should only get this level of insurance if you are in the financial place to do so. 100 MILLION DOLLAR UL POLICY. 500000 1 Million and 2 Million 3 Million 4 Million and 5 Million liability limits Each limit is available with host liquor liability coverage.

A policy with 1 million in coverage will cost more than the same kind of policy with only 100000 in coverage. This is the best way to keep the cost low. 5835000MONTHLY 68423000ANNUALLY Although these rates are what a quoter spits out.

25-Year Term Monthly Premium. Protecting your loved ones financially in case of the unexpected is a primary component of any good financial planBut just having coverage typically isnt enoughRather having the right amount of protection is the key and when you add up the cost of income replacement debt payoff and future financial needs the numbers can seem a. The cost of a policy varies based on your age health and other risk factors.

A million-dollar whole life policy often costs 800 a month or more even if you purchase the policy young. You may find the premium on a 1 million policy is only a little bit higher than it is for 500000. For a basic 1 million general liability insurance policy a business may pay anywhere between 300 and 1000 a year depending on the above factors.

A healthy 50-year-old can get a policy for 101 per month for men and 81 per month for women. Do you need a million dollar life insurance policy. If youre making an above-average income it makes sense to get a 3 million dollar policy.

Now that you understand the different factors that are used by the insurance company we can look at generic quotes to give you an idea of how much you would pay for coverage. A 1 million policy can be useful if you need it to cover. As we mentioned because there are variables that are used these are only ballpark numbers for insurance policies each person could receive drastically.

Cost of a One Million Dollar Term Life Insurance Policy. What makes term even better is that larger policies cost less on a per thousand basis than smaller policies do. The best companies include Banner Life Protective and Lincoln Financial.

However they dont always increase by that much so make sure you look at different quotes for. 100 MILLION DOLLAR TERM POLICY FOR 30YRS. Learn how much a 1 million-dollar life insurance policy costs with no exam in 2021.

Early in life costs for 3 million dollar life insurance policies are pretty affordable. A million dollar life insurance policy may not be as expensive as you think. View sample rates and get covered in under 5 minutes.

Shorter terms mean lower costs because once again your insurer takes less risk of a payout. However the million dollar policy wont cost 10 times more even though its 10 times larger. By comparison you might be able to get a million-dollar term policy for less than 100.

For most families term is the better option. How much does a million-dollar life insurance policy cost. Depending on the underwriter you choose you can get a million dollar insurance policy coverage for roughly 80 per month.

30-Year Term Monthly Premium. A lower premium applies to events with no alcohol. The good news is term life insurance isnt nearly as costly as most people think.

General Liability Insurance Cost Insureon

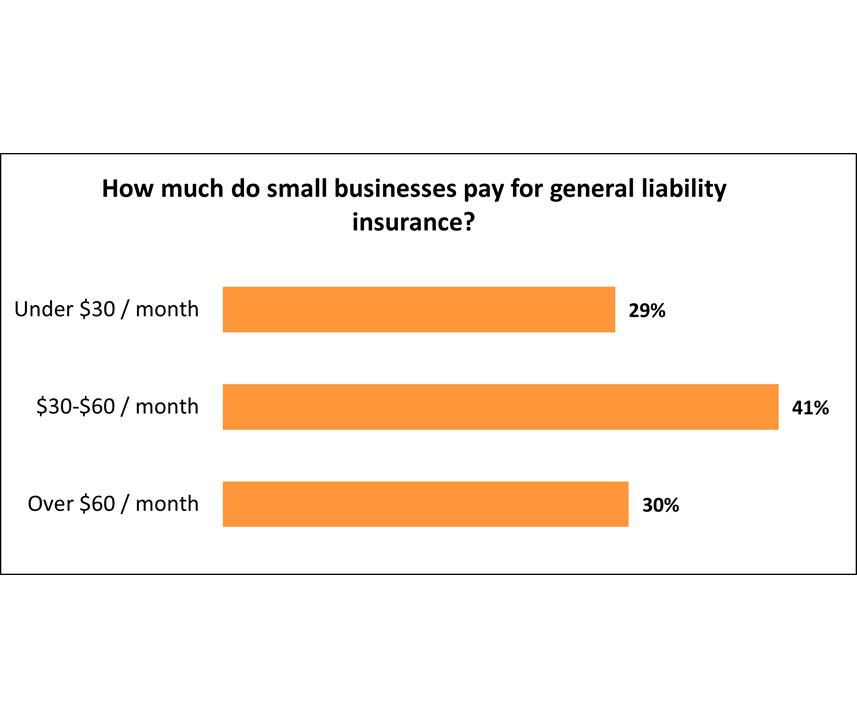

Understanding Short Term Limited Duration Health Insurance Kff

How Does Whole Life Insurance Work Costs Types Faqs

Zero To 100 Million In 3 Years A Lemonade Transparency Chronicle

Can You Have More Than One Life Insurance Policy Forbes Advisor

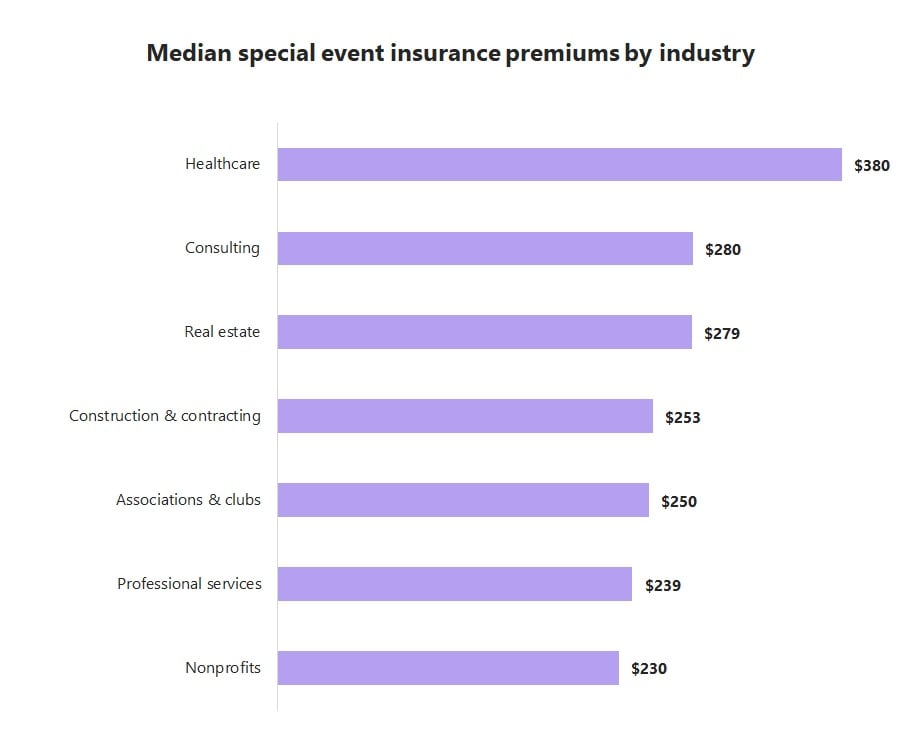

Special Event Insurance Cost Insureon

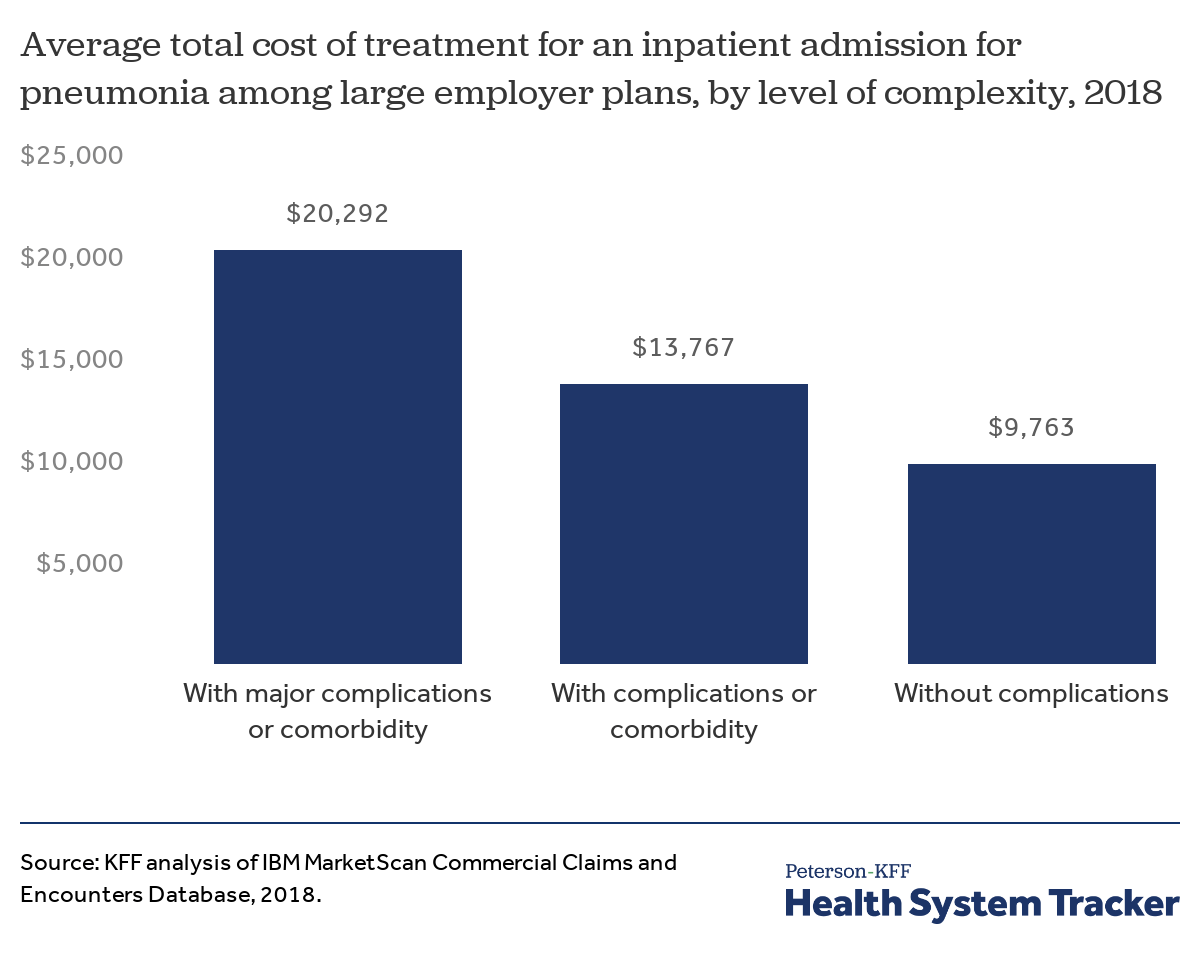

Potential Costs Of Covid 19 Treatment For People With Employer Coverage Peterson Kff Health System Tracker

Special Event Insurance Cost Insureon

Five Things To Know About The Cost Of Covid 19 Testing And Treatment Kff

2021 Final Expense Life Insurance Guide Costs For Seniors

General Liability Insurance Cost Insureon

Wedding Liability Insurance Event Venue Liquor Liability Wedsafe

How Much Does Million Dollar Life Insurance Cost Who Needs It

![]()

Potential Costs Of Covid 19 Treatment For People With Employer Coverage Peterson Kff Health System Tracker

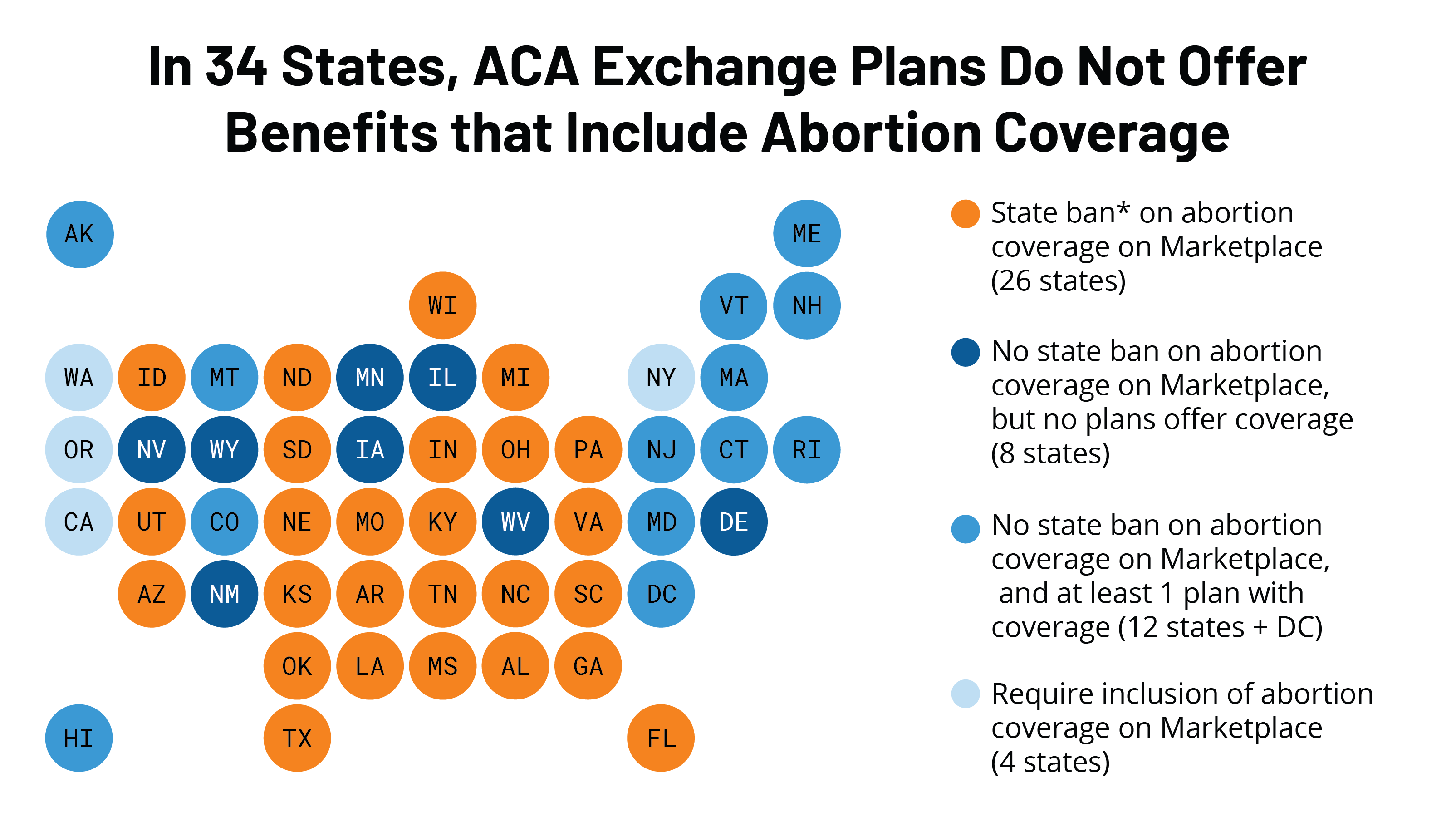

Coverage For Abortion Services In Medicaid Marketplace Plans And Private Plans Kff

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

Post a Comment for "One Day Million Dollar Insurance Policy Cost"