Loss Of Rental Insurance Taxable

Therefore a payout from the insurance company is reportable rental income. However you will work it through the casualty and thefts section under the Deductions and Credits tab.

Where My Monthly Paycheck Goes Japan Countryside Oc Dataisbeautiful Japan Countryside Paycheck Japan

Thats when your alternative accommodation turns into loss of rent cover.

Loss of rental insurance taxable. Loss of rent insurance to cover your lost income If the damage to your property is going to take a long time to fix your tenants are likely to move on rather than stay in temporary accommodation. The taxability of that insurance payout is offset by the qualified rental expenses it is used to pay for. Text Size We recently received a payment for loss of rent at a property after a fire made it uninhabitable.

This can occur where the amount of the insurance recovery exceeds the businesss depreciated tax basis in the destroyed property. How much a rental property owner may deduct depends on. I have an on-going insurance claim following a water leak.

The Role of Insurance After a Disaster. Are insurance proceeds for loss rental income taxable. Amount of Casualty Loss Deduction.

Lease loss insurance coverage or lack of use protection reimburses a landlord for. I believe they are but I cannot find the appropriate IRS Code section to verify the tax treatment. Should we declare it on the accounts as income.

By Readers Question 1841 PM 8th May 2014 About 7 years ago 7. It needs to be declared. When you have recovered any quantity from insurance coverage on the property thats rented out the quantity recovered is taxable and needs to be reported as a part of your rental earnings.

Life insurance pay outs are usually not subject to income or capital gains tax. Losses on the other hand serve as deductions. For instance the gain is not taxable to the extent the insurance proceeds are used to replace the property with similar property within two years.

A rental property owner may take a deduction for casualty. In general there is taxable income if the amount received from the insurance policy is more than the cost of what was lost. If you then receive a settlement from your insurer that exceeds 14000 the balance would be.

That way the payout will not be taxed. Yes of course but a good question. However there is a chance that you will have to pay taxes on the moneys you collect from your insurance claim depending on the specific circumstances.

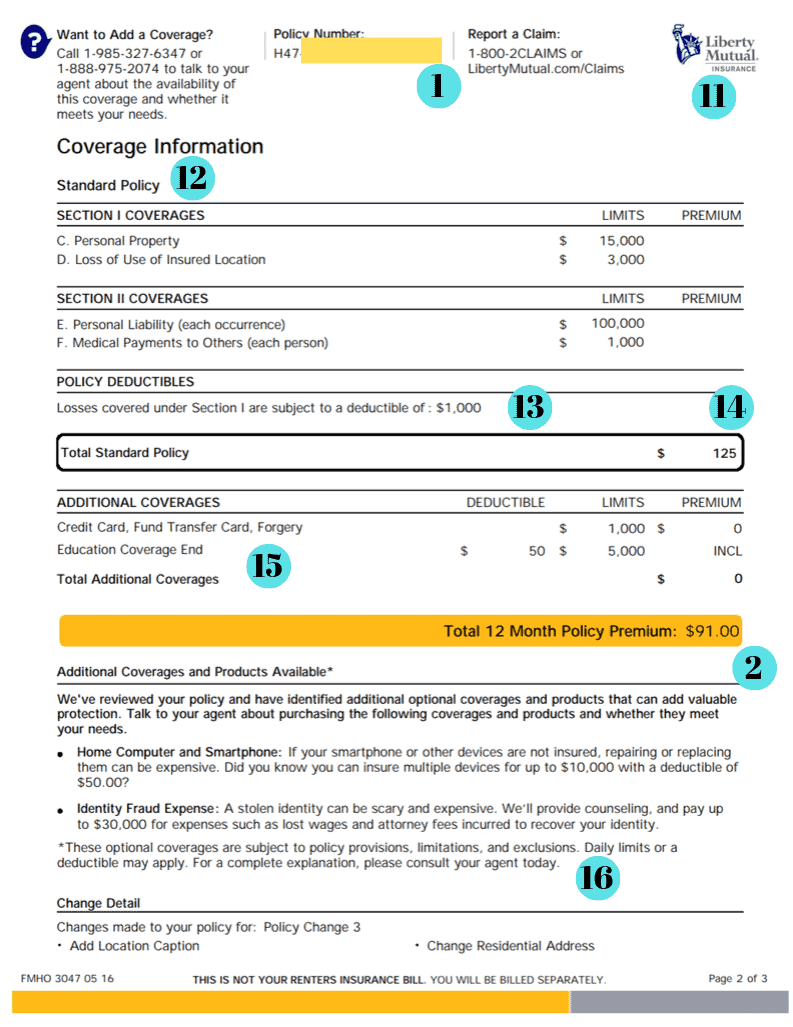

Generally speaking moneys that businesses collect from their insurance companies after filing a claim are not considered taxable income - particularly if the amount you receive is 5000 or less. Where however a coverage limitation is applicable to the total amount payable for increased living expenses and for example loss of rental income the amount of an unitemized settlement which is allocable to increased living expenses may not exceed the portion of the applicable coverage limitation which bears the same ratio to such limitation as the amount of increased living expenses bears to the. Loss of Rental Insurance Claim - taxable income.

A 20000 vehicle might depreciate by 2000 annually. A property owner cant avoid this rule by not filing an insurance claim. New Kitchen being replaced under insurance and a claim going through for loss of rental income.

This means well start paying you your normal rental income. Youll reportclaim your losses along with the insurance payout there. However it may be that the beneficiary or beneficiaries must pay inheritance tax.

When you paid for that rental property insurance it was a deductible rental expense. If you had to pay to rehouse your tenant you would put that in as a loss so having a payment to cover income should surely go in as a gain. Those earnings will be taxable as capital gains which is a good thing because capital gains are taxed at a lower rate than ordinary income.

Generally a Rental Dwelling Insurance Policy includes up to 85 of lost rents for anywhere from the end of the current lease to 6 months usually whichever is less. Indeed a timely insurance claim must be filed even if it will result in cancellation of the property owners policy or an increase in premiums. A rental property owner may take a deduction for casualty losses only to the extent that the loss is not covered by insurance.

Therefore after three years your cost basis in the vehicle has decreased to 14000 because you deducted the balance from your taxes. Many business owners are surprised to learn that the receipt of an insurance recovery for a fire or other casualty loss may result in taxable income. But unfortunately the excess loss the.

It gets included as a part of all rental income received. Loss of rent caused by denial of access at another premises within the vicinity of the insured property loss or damage caused by an insured peril happening at the premises of a managing agent resulting in the reduction of rent at the insured premises. However there are also exceptions to this rule.

Deducting Losses in Federal Disaster Areas from Prior Year Taxes. If the loss is fully covered there is no deduction. Is a loss of rent insurance payout treated as taxable income.

Insurance coverage reimbursement for lack of rental earnings taxable. The govuk website explains that. You deduct the insurance premiums as a loss so the payout is a gain.

Latest Tds Rates Chart For Financial Year 2017 2018 Fy Ay 2018 2019 New Tds Limits List Table Fixed Deposit R Income Tax Income Tax Preparation Tax Preparation

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

1231 1245 And 1250 Property Used In A Trade Or Business Investing Infographic Investment Quotes Investing

Your Bullsh T Free Guide To Taxes In Germany

Australia Negative Gearing Rules Google Senior Management Graphing Negativity

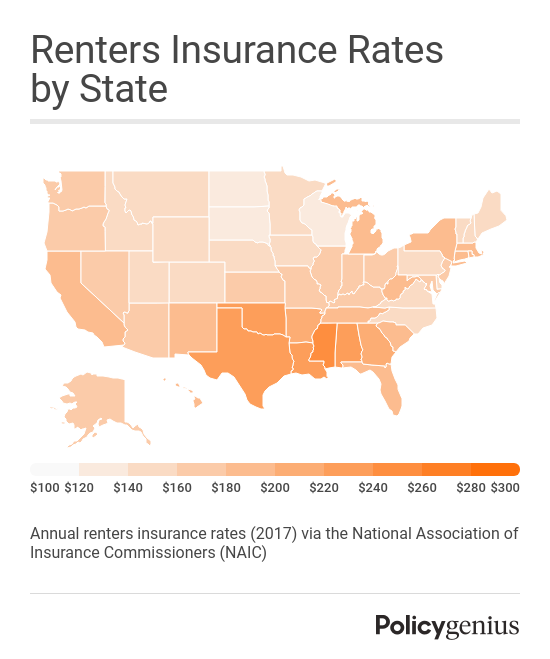

What Is Renters Insurance And How Much Do You Need

What Is Renters Insurance And How Much Do You Need

Key Man Life Insurance And Taxation Auto Insurance Quotes Car Insurance Insurance Quotes

Rental Income Property Analysis Excel Spreadsheet In 2021 Financial Statement Rental Property Statement Template

The Ultimate 5 Property Rental Real Estate Template Excel Template For Landlords Rental Property Template Rental Property Being A Landlord Profit And Loss Statement

An Invoice Is Required For Every Form Of Supply Such As Transfer Barter Exchange License Rental Lease Or Disposal Gst Requir Invoicing Invoice Format Tax

How Much Is Renters Insurance Average Renters Insurance Cost 2021

Filing Your Tax Return Don T Forget These Credits Deductions Small Business Tax Small Business Bookkeeping Bookkeeping Business

When Calculating The Profit Or Loss For A Propertyrentalbusiness It Is Important That Nothing Is Overlooked The Receipts Whi Rental Business Business Rental

Loss Of Use Coverage In Home Insurance Know The Rules

Https Assets Airbnb Com Help Airbnb Pwc Taxguide Germany En Pdf

Post a Comment for "Loss Of Rental Insurance Taxable"