Income Protection Insurance Uk Martin Lewis

Being unable to earn is less of a worry when you know your wages are protected. Income protection refers to a range of insurance policies designed to ensure youll continue to receive an income if youre unable to work due to illness or disability.

Martin Lewis Life Insurance Compare Quotes 15 Secs 2021 Update

If it is your salary then income protection is a.

Income protection insurance uk martin lewis. There are several different types of cover available with short term policies that generally pay out for up to two years and long-term. Traditionally income protection is one of the least popular products people take out. Decide when the monthly payments start deferment period of 4 8 13 26 or 52 weeks after incapacitation.

Long-term income protection LTIP previously known as Permanent Health Insurance this is not to be confused with private health insurance which covers medical costs. Grab the latest deals guides tips n tricks directly from Martin and the MSE team. Dz bank upgraded the previous rating for exxon mobil corp nysexom from sell to hold.

It depends on what you want to cover. Martin lewis is a registered trade mark belonging to martin s lewis. Its a kind of salary protection insurance to make sure you get a regular income until you retire or can go back to work.

60 of your salary before tax per month up to a payment of 5000 per month And then 50 after this capped at a payment of 16666 per month. Most income protection insurance policies are short-term. Payments usually continue until retirement death or you return to work.

Minimum - 50 per month. Income protection insurance is an insurance policy that pays out an income if you are unable to work due to illness or an accident. Formerly known as permanent health insurance income protection is an insurance policy that pays out if youre unable to work because of injury or illness.

03301 222752 helplewishullincouk Home. According to a recent survey by Which. There are many different ASU policies available including Payment Protection and Mortgage Payment Protection Insurance.

These are totally different products. In such situations income protection can give great peace of mind as an insurance policy that pays out if youre unable to work because of injury or illness. Short-term income protection insurance is also available where payments are.

While you cant receive 100 of your salary you can typically get 70 of your income before tax. LTIP means you can protect a portion of your income often half to two-thirds of your gross salary if illness or an accident means youre unable to work. Get our free weekly Money Tips email.

Maximum - 4167 per month max income replacement ratio is 50 per cent gross taxable income Income Cover 2 year. Often referred to as sickness insurance or disability insurance. Unlike most short-term.

Income Cover 2 year. Income protection is one of the most important insurances as without a regular income you could be hard-pressed to pay the bills. In the fourth.

When youre self-employed or a contractor you get the sweet perk. A monthly income payable for up to 2 years Basis of Cover. The irony of this is that its generally one of the ones most needed.

So if you died five years into the policy your dependents would receive 10k for each of the remaining five years. With our Income Protection Cover Plus you can protect. Which kind of Income Protection do I need.

Martin Lewis is a registered trade mark belonging to Martin S Lewis. Why is income protection insurance important. This will depend on how long you require your policy to pay you an income.

Family income benefit FIB provides a regular income rather than a lump sum This provides an annual tax-free payment for the length of the policy term eg 10000yr for 10 years. From mortgages to insurance we do the leg work to make sure our clients get the best advice to match their needs. The critical illness policy would pay out a lump sum on the diagnosis of a specified critical illness whereas an income protection policy pays out a regular monthly income if you are unable to work and continues to pay until you do go back to work or until the policy end date.

AIG Income Protection insurance policies range from 5 to 53 years so you can choose the length that suits and an NFU Mutual Financial Adviser can advise on the level of protection you may need. Income protection usually pays out until retirement death or your return to work although short-term income protection policies which last for one or two years are also available at a lower cost. Typically the period of cover would be about 20 to 30 years and could be taken to cover a mortgage or loan or to protect your family.

Get the latest exxon mobil corporation xom stock news income protection insurance martin lewis and headlines to. Get access to a wide network of private UK medical facilities and choose from a range of flexible healthcare benefits the ideal all-round cover for you and your family. The power of social media the importance of income protection and taking protection to the masses.

Some 41 of people secured life insurance. Monthly benefit MinMax benefit level. Income protection cover is different from critical illness cover.

Why protection advice needs its own Martin Lewis. Monthly benefit Income Cover 2 year. Income Protection articles.

Short-term Income Protection policies which are otherwise known as Accident Sickness and Unemployment ASU products will generally only pay out for one or two years. Long-term income protection is available too will provide a regular income for a longer pre-agreed period until you are well enough to return to work. Even if your budget is tight - well help you prioritise which cover is best for you.

Explore health insurance. Get our free money tips email. They pay out for a set period usually up to two years while you get back on your feet and return to work.

You pay a regular monthly premium for a set period or term at the end of which the policy expires. Read about managing challenges and returning to work. Income protection insurance covers you if you cant work because of illness or injury.

For all the latest deals guides and loopholes join the 12m who get it. Policies are generally designed to pay out until you reach retirement age. Term Life Insurance is a cheap form of life insurance that covers you and those assured in the event of death or a critical illness.

On this months COVER Podcast editor Adam Saville is joined by Matthew Chapman a protection adviser for Plus Protect who has this week started his own agency MCAB to provide sales.

Mortgage Life Insurance Save 100s Every Year Mse

Mortgage Life Insurance Save 100s Every Year Mse

Martin Lewis Life Insurance Compare Quotes 15 Secs 2021 Update

Martin Lewis Biography Find Out About The Money Saving Expert

Martin Lewis Life Insurance Compare Quotes 15 Secs 2021 Update

Life Health Insurance Guides Moneysavingexpert

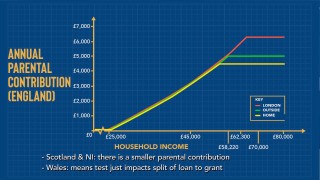

Martin Lewis Tells Ministers It S Time To Stop Hiding The Student Living Loan Parental Contribution Parents Should Be Told They May Be Expected To Pay 1 000s

Martin Lewis Life Insurance Compare Quotes 15 Secs 2021 Update

Martin Lewis Life Insurance Compare Quotes 15 Secs 2021 Update

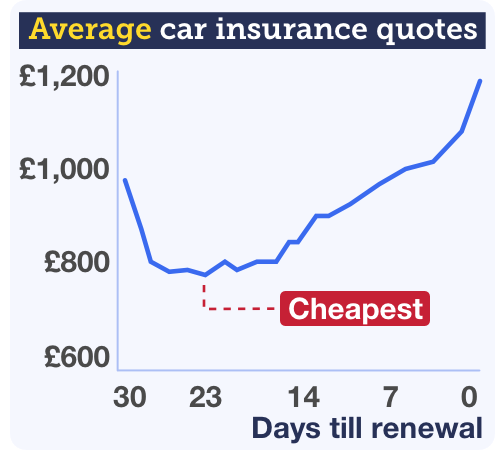

02 June 2021 Huge Car And Home Insurance Shake Up Coming Check Now If You Can Save

What Martin Lewis Said About Our Over 50 S Life Insurance

Martin Lewis Money And Mental Health What A Year 2020 21

02 June 2021 Huge Car And Home Insurance Shake Up Coming Check Now If You Can Save

Mortgage Life Insurance Save 100s Every Year Mse

Martin Lewis Explains How Much Life Insurance You Really Need Express Co Uk

![]()

Best Income Protection Insurance Moneysavingexpert Forum

Martin Lewis Life Insurance Compare Quotes 15 Secs 2021 Update

Martin Lewis Life Insurance Compare Quotes 15 Secs 2021 Update

02 June 2021 Huge Car And Home Insurance Shake Up Coming Check Now If You Can Save

Post a Comment for "Income Protection Insurance Uk Martin Lewis"